Elevated interest rates contribute to a decline in homebuilding, but the surge in permits buoys well for future residential construction. Manufacturing construction remains solid.

Government introduces stimulus measures to residential property but in a piecemeal fashion to avoid adding to increasing public debt. Infrastructure supports overall construction activity.

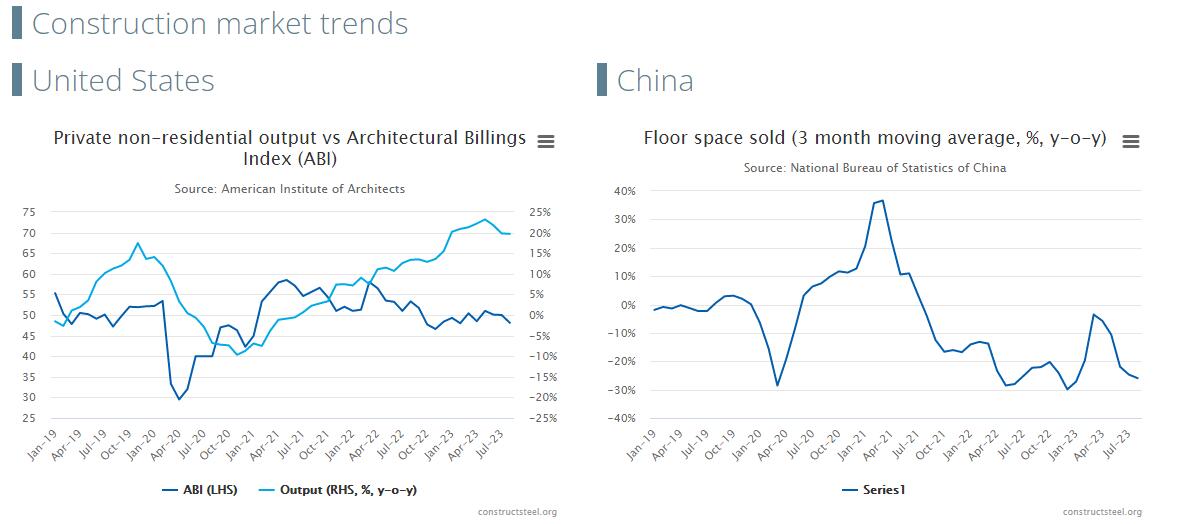

The 3-month moving average y-o-y decline in floor space started reached -28% in August; floor space sold was down -26% y-o-y during the same period. Railway investment is up 23% year-to-date, y-o-y in August.

Eurozone construction activity remains weak; construction confidence in negative territory.

A favourable monsoon contributes to double-digit expansion in the core index of industrial activity.

Weighted average of eight core industries’ output rose by 12% y-o-y in August; steel production up 11%, and cement up by 19% y-o-y.

EXPOGROUP Supports The"GO GREEN"

EXPOGROUP Supports The"GO GREEN"